Media Events

ISO Certifications

We are proud to announce that we are ISO 20000-1:2018 (IT Service Management System), ISO 27001:2022 (Information Security, Cybersecurity & Privacy Protection) and ISO 22301:2019 (Business Continuity Management System) certified!

Together, we are shaping a Bright Future.

IT Service Management System (ISO 20000-1:2018)

IT Service Management System (ISO 20000-1:2018) Certificate

This marks a significant milestone in our commitment to delivering world-class IT service management and ensuring operational excellence for our customers.

IT Service Management System (ISO 20000-1:2018) Certificate

Information Security, Cybersecurity & Privacy Protection (ISO 27001:2022)

Information Security, Cybersecurity & Privacy Protection (ISO 27001:2022) Certificate

This globally recognized certification reinforces our dedication to top-tier information security, cybersecurity, and privacy protection - keeping your data safe, always!

Information Security, Cybersecurity & Privacy Protection (ISO 27001:2022)

Business Continuity Management System (ISO 22301:2019)

Business Continuity Management System (ISO 22301:2019) Certificate

This underscores our unwavering commitment to business continuity, ensuring we remain resilient and prepared to serve you no matter what!

Business Continuity Management System (ISO 22301:2019)

Management Retreat

Management Retreat

Our two-day Bank-wide Management strategy retreat was marked by innovation, collaboration, and strategic planning, fostering a shared commitment to make a substantial impact - internally and externally in 2024.

Together, we are shaping a Bright Future.

Orange Valentine

Orange Valentine

This Valentine's Day, we spread love and joy in a special way!

As part of our OrangeValentine2.0 campaign, we surprised our amazing audience with shopping vouchers to celebrate their loved ones, encouraging them to share the spirit of love on Valentine's Day. This initiative not only promoted love and appreciation but also fostered stronger connections within our community.

Orange Valentine

Fun Night

All work and no fun? Not on our watch!

A recap of our Orange Valentine fun night

Leadership Thought

Leadership Thought

It was a great pleasure hosting incredible women for an inspiring #IWD Leadership Thoughts event yesterday! Our MD/CEO, Taiwo Joda shared insightful leadership nuggets and inspired inclusion.

It was a true celebration of female empowerment and a testament to Accion MfB's commitment to fostering leadership excellence for all.

Her Story

Her Story

In honour of International Women�??s Day, we�??re highlighting the inspiring journeys of some of our incredible female staff. They shared powerful advice that offers valuable insights for any career woman aiming for success.

Their stories show how Accion MfB fosters an inclusive environment that empowers women to reach their full potential.

Inspire Her I

Inspire Her I

To honour International Women's Day this year, we decided to celebrate the power of women entrepreneurs!

Our first feature is one of our incredible female customers, Odunayo Falilat.

She shares inspiring stories of how Accion has empowered her to grow her businesses and achieve her dreams.

Our commitment to women-owned businesses is unwavering. We will continue to provide the resources and support they need to flourish at all times.�?�

Leadership Thought with TJ 1.0

Leadership Thought with TJ 1.0

We were delighted to host a group of accomplished professionals at our headquarters for an engaging leadership forum led by our MD/CEO, Taiwo Joda.

Chartered Institute of Bankers of Nigeria’s Visit to the Head Office

Chartered Institute of Bankers of Nigeria’s Visit to the Head Office

We were honored to host representatives from The Chartered Institute of Bankers Nigeria [CIBN] at our headquarters. The esteemed CIBN team engaged in productive discussions with our MD/CEO and Senior Management staff, followed by a tour of our facilities. During this enriching exchange, some of our Graduate Training Programme graduates had the opportunity to interact with the CIBN team, gaining valuable insights into the institution’s pivotal role within the financial ecosystem

Plant a Flower

Plant a Flower

This project was exclusively designed for our staff members to plant a flower at their workstations. It serves as an internal effort to champion sustainability and enhance the aesthetics of their workspace.

Celebration of CBN Global Money Week

Celebration of CBN Global Money Week

In honor of Global Money Week, themed "Plan your money, plant your future" we had the privilege of visiting two remarkable schools: Saviour Nursery & Primary School in Bariga, Lagos, and Success Point Academy in Oju Ore, Ogun State. It was a joyous occasion as we engaged with the students, imparting valuable lessons about the significance of money and the importance of saving for future generations. At the end of the sessions, the children had the chance to ask questions, fostering a deeper understanding of financial matters. To further support their education, we gifted over Three Hundred (300) students in each of the schools with diverse back-to-school kits. It was a day of learning, sharing, and giving back to our future leaders.

International Women’s Day

International Women’s Day

We need women at all levels, including the top, to change the dynamic, reshape the conversation, to make sure women’s voices are heard and heeded, not overlooked and ignored. ‐ Sheryl Sandberg We had a wonderful time at the 4th DBN [Development Bank of Nigeria] International Women's Day Celebration. Theme: Banking Small and Medium Size Enterprises to Build a Better Nigeria. Together with other corporate organizations, we celebrated the remarkable achievements of women and joined in advocating for women's rights in Nigeria and around the world. It was an inspiring and empowering event.

Youth Empowerment and Inclusion

Youth Empowerment and Inclusion

Continuing our commitment to financial inclusion, we were delighted to host the Lagos State University of Science and Technology (LASUSTECH) SUG President and his executive team at our headquarters in Lagos. Our aim is to persistently cultivate an environment where both the youth and individuals from diverse backgrounds can flourish and prosper within the financial sector.

International Health Day

International Health Day

Good health is not something we can buy. However, it can be an extremely valuable savings account. ‐ Anne Wilson Schaef In observance of World Health Day, we organized free medical check-ups for our customers and select staff members. It was a privilege to have our valued customers join us for this important health initiative.

Collaborate not compete

Collaborate not compete

As part of our ongoing efforts to nurture strong relationships and connections within the ecosystem, we were honored to host Nirsal MfB at our headquarters. It was a productive and enriching interaction

Welcome Onboard, Peerless 2023

Welcome Onboard, Peerless 2023

We are thrilled to have our new hires commence their graduate training class as they embark on this new and interesting journey with us. Here's to a bright future filled with knowledge, growth and endless possibilities!

Expanding the frontiers of Risk, Control and Compliance

Expanding the frontiers of Risk, Control and Compliance

we are excited to host the representatives of LAPO Microfinance bank where they exchanged adequate knowledge with staff members including understanding the processes in our Risk, Control and Compliance department.

Children’s Day Celebration: Unlocking Minds: School Tour Adventure in Celebration of Children’s Day

Children’s Day Celebration: Unlocking Minds: School Tour Adventure in Celebration of Children’s Day

In celebration of Children’s Day in May, we were honored to host students from Learning Gate School and Fortlad Private School at our headquarters. During their visit, they had the valuable opportunity to gain insights into how our various departments collaborate to ensure the Bank operates efficiently. There's nothing quite like the experience of inspiring the leaders of tomorrow by engaging with them from a young age.

17th Annaul AGM

17th Annaul AGM

The 17th Annual General Meeting was held today at the Accion MfB headquarters in Lagos, with the presence of our esteemed Board Members and Senior Management Staff.

Supporting Success Stories: Additional Store Opening by Our Customer

Supporting Success Stories: Additional Store Opening by Our Customer

As a trailblazing financial institution with 16 years of dedicated service, we remain steadfast in our mission to empower and transform lives and businesses. Our commitment to responsible banking practices, coupled with purpose-driven initiatives and strategic partnerships, has left an indelible mark on countless lives and businesses throughout Nigeria. One shining example of our impact is Kodo Ekeson Nigeria Enterprise, which recently inaugurated new outlets in Lagos. Our Managing Director and two management teams graced the occasion, reflecting our unwavering support.

Supporting Youths Driving Sustainability

Supporting Youths Driving Sustainability

we spotlighted the inspiring stories of Nigerian youths who are creating remarkable products from waste materials, showcasing their innovative contributions to a more sustainable future

Bright Minds Initiative ‐ Secondary School Debate: Where Young Minds Clash and Ideas Shine.

Bright Minds Initiative ‐ Secondary School Debate: Where Young Minds Clash and Ideas Shine.

As part of its commitment to empowering the next generation of leaders, Accion Microfinance Bank has launched a secondary school debate under the title: "Bright Minds Initiative." The project seeks to offer a platform for young students to showcase their intellectual abilities, communication skills and critical analytical skills while expressing their views on relevant societal issues. The maiden edition of the programme held at the bank's headquarters in Lagos State recently brought together representatives of four secondary schools; Winning Gate School, Fountain of the Lord Glory School, Prestige Private College and Mescoj School to compete on trending societal issues. After rounds of the debate, Mescoj School emerged the champion, while Winning Gate School and Prestige Private College took the second and third place respectively.

Accion Microfinance Bank Empowers Fashion Designers with A 2-Day Workshop

Accion Microfinance Bank Empowers Fashion Designers with A 2-Day Workshop

Accion mfb joined forces with CAFET to provide aspiring fashion enthusiast with vital insights into the world of fashion and business. This partnership aims to empower individuals with the knowledge and tools needed to succeed in the fashion industry. Together we�??re brought unique opportunity to explore enthusiast with essential insights on fashion the intersection and entrepreneurship, helping the attendees turn their passion into thriving business.

Mini Customer Forum in Kano and Abuja

Mini Customer Forum in Kano and Abuja

As a bank deeply committed to our customers, we value their feedback and believe in transparent communication. Our Chief Commercial Officer, Ndubuisi Onuoha, recently engaged with our Kano and Abuja customers in a mini forum. This initiative aims to strengthen the bond we share with our valued customers and keep them duly informed.

World African Day

World African Day

we celebrated our vibrant and rich cultures, heritage, diversity and boundless beauty as Africans. We are proud of our African roots, we stand united and determined to rewrite our stories of a Brighter Future.

Chartered Institute of Bankers of Nigeria (CIBN), Graduate Induction and Awards Ceremony

Chartered Institute of Bankers of Nigeria (CIBN), Graduate Induction and Awards Ceremony

It was a delight to witness the 2023 Chartered Institute of Bankers of Nigeria (CIBN), Graduate Induction and Awards Ceremony for the year, where we awarded the best student (Microfinance) with a prize. The prestigious prize was presented to the student by our Chief Operating Officer, Vincent Onwudinjo. we are committed to celebrating and supporting the next generation of banking leaders.

African Leadership Magazine Courtesy Visit to Head Office

African Leadership Magazine Courtesy Visit to Head Office

We were honored to have been presented with the August 2023 edition of African Leadership Magazine at our HQ in Lagos, Nigeria. This follows our recent conferment as African Leadership Microfinance Brand of the year 2023 at the Africa Business Leadership Awards which took place in the United Kingdom

2023 Customer Service week

2023 Customer Service week

Accion Microfinance Bank joined the rest of the world in celebrating the 2023 Customer Service Week with the theme �??Team Service 2023�?? with different activities such as management staff paying courtesy visit to customer amongst others. Accion Microfinance Bank enthusiastically participated in the global celebration of Customer Service Week 2003, under the theme �?? Team Service 2023.�?? Our commitment to delivering exceptional service was explified through a range engaging activities, including personalized courtesy visit by our managemnt staff of our valued customers, among other exciting initiatives. We wholeheartedly embraced this opportunity to strenthen our customer relationships, gain, invaluable insights and demostrate our unwaring dedication to providing world class service. This celebration not only boosted our team�??s moral but also reaffirmed our customer centric culture. Ensuring that we continue to serve our customers with excellence.

Independence Day Celebration - Carnival of Colours

Independence Day Celebration - Carnival of Colours

We came together as a nation in vibrant Canival of Colours: during the Independence Day Celebration, united by our pride and shared history. This festival of occasion allowed us to revel the richness in our culture, diversity and the enduring spirit of our country. It was a powerful demonstration of our collective unity and patriotism, making this year�??s Independence Day Celebration a truly memorable and significant one.

The bank Hosted the Consumer Centrix Team

The bank Hosted the Consumer Centrix Team

In our relentless pursuit of financial inclusion, we were privileged to host the Consumer Centrix team. They shared their groundbreaking approach to harnessing data for bridging the gender-based financial inclusion gap in Nigeria. Together, we're making financial services more inclusive and equitable

Lagos State Chapter of the National Association of Microfinance Banks (NAMB)

Lagos State Chapter of the National Association of Microfinance Banks (NAMB)

Our MD/CEO Taiwo Joda being the immediate past Chaiman of the association hosted the current excos of National Association Microfinance Bank (NAMB).

Development Bank of Nigeria (DBN)

Development Bank of Nigeria (DBN)

We were honored to host the esteemed Development Bank of Nigeria (DBN) team at our headquarters. Our MD/CEO, Taiwo Joda, and our management staff extended a warm welcome to the DBN delegates. Productive discussions and a guided tour of our facilities ensued. Together, we're forging new paths for financial development and collaboration

Glad to have You on Board: Ark class 2023

Glad to have You on Board: Ark class 2023

We�??re excited to welcome our new graduate trainees to the journey ahead.

WORLD WOMEN BANKING

WORLD WOMEN BANKING

Women's World Banking workshop for Women-Centric Design, we explored data that helped understand how to cater to the needs of and communicate to women with barely any formal education - this included and was not limited to, Gender Aware Marketing and Gender Sensitivity Grounding.

Accion x Justrite Launch

Accion x Justrite Lunching

Accion MfB recently partnered with Justrite Superstore on the "Buy Now. Pay Later." Project. The project is aimed at making loans accessible through the AccionWallet App were individuals can shop at any Justrite Superstore with zero cash.

Creche

Creche

We are thrilled to announce the recent official launch of Accion Staff Creche in line with our commitment to inclusivity in the work place. The staff creche offers quality child care and a safe and protected space in order to support our Accion Mums. Indeed, there is an obvious need to create a warm and comfortable environment for staff [including nursing mothers]. Here's to many more Accion MfB babies!

Sick Bay

Sick Bay

Good health is not something we can buy. However, it can be an extremely valuable savings account.�??- Anne Wilson Schaefer. We recently launched a sickbay at our Head Office with qualified medical personnel to give first hand treatment to staff. Ensuring our staff works in a safe and healthy space is one of our topmost priorities. Health is wealth!

Customer Service Week

Customer Service Week

Customer service week was indeed memorable. Management Staff also participated in celebrating customer service week by engaging with the bank�??s customers directly. To wrap it up, the duty of service was also represented as Management staff served staff members with food and drinks, initiated Karaoke game, and one or two were disk jokey for a day. We are always excited to celebrate our customers and provide exceptional service delivery which would never be possible without our amazing team. Happy Customer Service Week!

Accion Star

Accion Star

We had a splendid time hosting our Accion Stars at the head office They had fun learning about the bank and how their parents contribute to its success. There were movies, games and lots more! It was such an incredible time

5th Annual Financial Inclusion Seminar

5th Annual Financial Inclusion Seminar

The 5th Annual financial inclusion seminar was a success. We had guest speakers discuss the importance of using big data to improve customer experience. Attendees from other financial institutions were present at the event. Media coverage was carried out by BellaNaija. Looking forward to 2023!

DTXForum

DTXForum

The MD/CEO Taiwo Joda was present at the DTXForum where he joined Sasidhar Thumulluri of Sub-k Impact Solutions Ltd, Edgardo Perez of Fundacion Genesis Empresarial and moderator Victoria White of Accion to share how efficient digitalization has been to the bank.

International Financial Inclusion Conference in Abuja

International Financial Inclusion Conference in Abuja

The National financial inclusion steering committee headed by the central bank of Nigeria (CBN) hosted nigeria�??s maiden international financial inclusion conference (IFIC�??22) this week. Accion MfB team was in attendance and engaged the miniter of information, Lai Mohammed CBN governor, Godwin Emefiele, and Minster of FCT, Alhaji Mohammed Musa bello CON at the ongoing international Financial Inclusion conference in Abuja.

15th Annual Banking & Finance Conference

15th Annual Banking & Finance Conference

Thrilled to announce we emerged �??Most Supportive Microfinance Award�?? at the Annual Banking & Finance conference! Our vice chairman Dr Segun Aina also graced this event and the award received by our MD/CEO, Taiwo Joda. Proud to share this milestone and also appreciate our esteem customers and stakeholders for the consent support!

CBN Financial Inclusion Week

CBN Financial Inclusion Week

We are live at the CBN Financial Inclusion Week (Bola Ige International Market) Egbeda Local Government Ibadan, Oyo State.

15 years Anniversary

15 years Anniversary

15 years in the Microfinance sector is no small feat! A decade and an additional 5 years of impacting our customer�??s businesses and transforming lives. This journey would not have been possible without the leadership and guidance of our Board and Management staff, the consistency and dedication of our staff, and the loyalty of our highly valued customers. Here�??s to the next 15!

Fischer: Digital Financial Services Critical for Inclusive Recovery

Fischer: Digital Financial Services Critical for Inclusive Recovery

The Chief Investment Officer at Accion, and Chairman of the Board of Accion Microfinance Bank in Nigeria, Mr. John Fischer, in this interview speaks about how financial institutions can aide growth post-covid, plans of his organisation and other pertinent industry issues. Nume Ekeghe presents the excerpts

What is Accion's most noteworthy strategic goals in supporting businesses globally?

While the end of the COVID-19 pandemic is in sight for some people in wealthier countries, many communities around the world

are currently facing the worst of the crisis.

Digital financial services have a critical role to play in fostering an inclusive recovery �?? helping small businesses stay open,

community pharmacies remain stocked, and families access safe places to save and borrow money. Accion is working to ensure that

low-income families and small businesses who are most affected by the crisis have access to the financial tools they need to survive,

begin to recover, and establish their financial resilience for the future.

Where are the potential areas of growth/opportunity in the Nigerian economy and how is Accion international

supporting Accion MFB and businesses to harness these opportunities?

The pandemic has dramatically accelerated the shift to digital around the world. A recent report from GSMA revealed, for example, that mobile

money accounts globally grew by 13 percent in 2020, to reach a total of more than

1.2 billion. As more businesses and transactions move online, this opens doors to security and growth for those who have long relied on cash

and in-person transactions to conduct business and manage daily life. Accion is ramping up efforts to help our partners leverage new digital

technologies to support vulnerable families and small businesses and help them build financial resilience. Through our investments, advisory services, research, and a first-of-its kind partnership with Mastercard, we are helping microfinance institutions (MFIs) like Accion Microfinance Bank leverage digital technologies to reach more clients and serve their clients more effectively.

How Accion MFB helped customers survive pandemic year

How Accion MFB helped customers survive pandemic year

Accion Microfinance Bank Limited has been recognized for putting structures in place that reduced the effects of the pandemic on the staff and customers of the bank.

John Fischer, chairman of the bank, who commended the management at the bank's annual general meeting in Lagos, also noted how the bank leveraged technology and optimized innovative solutions to improve customer experience and service.

Fischer said the focus of the bank during the year was to help the bank's loan clients to navigate the financial impact of the pandemic on their businesses. As a result, the bank extended a grace period to 23,307 of its loan clients for a minimum of 90 days, while those in the educational sector got a grace period of at least 150 days. Additionally, the bank waived interest for five months for loan clients in the educational sector which was among the hardest hit

Among the financial highlights presented by the chairman include an increase in customers' deposits by 7.38 percent from N4.013billion to N4.309 billion, and a 2.29% growth in the bank's total equity grew from N5.246 billion in 2019 to N5.366 billion in 2020.

The bank remained capitalized well above the N5 billion capital base required for a national microfinance bank by regulation by April 2022. Speaking at the annual general meeting, Taiwo Joda, managing director/CEO, acknowledged that the bank's customers were particularly affected by the economic consequences of the global pandemic as they largely belong to the vulnerable segment of the society.

According to him, following the sudden lull in economic activities caused by the global lockdown, the bank responded with a mandate to build resilience and impact lives, based on a three-pronged approach of customer education, forbearance and constant availability.

Joda cited the resulting business survival and the intimate relationship cultivated with the bank's customers as among the key achievements of the year. He also expressed a sense of pride in how the bank kept faith with its core value of giving back to society through various CSR initiatives during the year.

https://www.thisdaylive.com/index.php/2021/06/03/paying-school-fees-from-plastic-wastes/

Paying School Fees from Plastic Wastes

Paying School Fees from Plastic Wastes

“The school opened in 2013 and the initiative started in 2016, but it became popular in 2018. The bank has been supportive regarding this initiative. There was a book the bank managing director gave me to read and it has changed my mentality and view of things. Moreover, the book has been a great support and it thought me how to manage a business properly. There was a time the bank brought bags for the kids in the school. They are also bringing plastics to pay the schools of some kids. From the little we have done we have been able to improve the standard of these poor families. We have helped to support 100 families to provide quality education for their children.”

The Role of the Bank At the center of this initiative is the unwavering support of Accion Microfinance Bank towards the growth and promotion of quality education in such underprivileged suburbs.

The bank has shown a strong passion for environmental sustainability especially by decommissioning the use of diesel generators in all their branches as a result of the smoke and the heat from the diesel which depletes the Ozone layer.

The bank has switched to renewable energy, therefore in all Accion MFB branches, they rely either on power from the national grid or solar power energy to generate electricity. The goal is to prevent noise and environmental pollution and that everyone has cleaner and better air to breathe.

Speaking during a CSR activity at Morit International School which was organised by the bank, the Managing Director, Accion Microfinance Bank, Taiwo Joda, said the bank was committed to supporting the vision of the founder of the school.

“We keyed into the vision of education for all, especially for children. We have helped him to grow and have supported up to 172 school pupils of the poor and vulnerable. The founder's overriding vision is to have education for every child and every family who cannot afford school fees in Ajegunle. The uniqueness of the proposition of the school is how school fees' are paid. The pupils use plastic bottles to pay their schools fees which are then recycled,” he stated.

Joda stated the bank gave an interest-free loan totaling N160 million in over five months to school owners, adding that despite the company's interest reduction in 2020, “they are determined to do more support students to grow.”

He also noted that education was key to fighting poverty and tackling unemployment.

The Accion boss further explained that the bank is passionate about education while expressing confidence that they hope to see the Morit International School strive and they would continue to support them.

He hinted that the uniqueness of the proposition of the school is how school fees are paid, stating that the pupils collect used plastic bottles and submit to the school to pay their school fees, “the school, in turn, gives the plastics to recycling companies.”

According to him: “We are here to support the vision of the founder of Morit International School who was also is the customer of the bank. He has been our customer for over six years. We keyed into the vision of education for all, especially for children.” https://www.thisdaylive.com/index.php/2021/06/03/paying-school-fees-from-plastic-wastes/

Women and Half

Women and Half

The Woman and Half is a platform that gives women from all walks of life an occasion to network and connect with other professional. Accion MfB is a proud collaborator for this annual event targeted at supporting and empowering women.

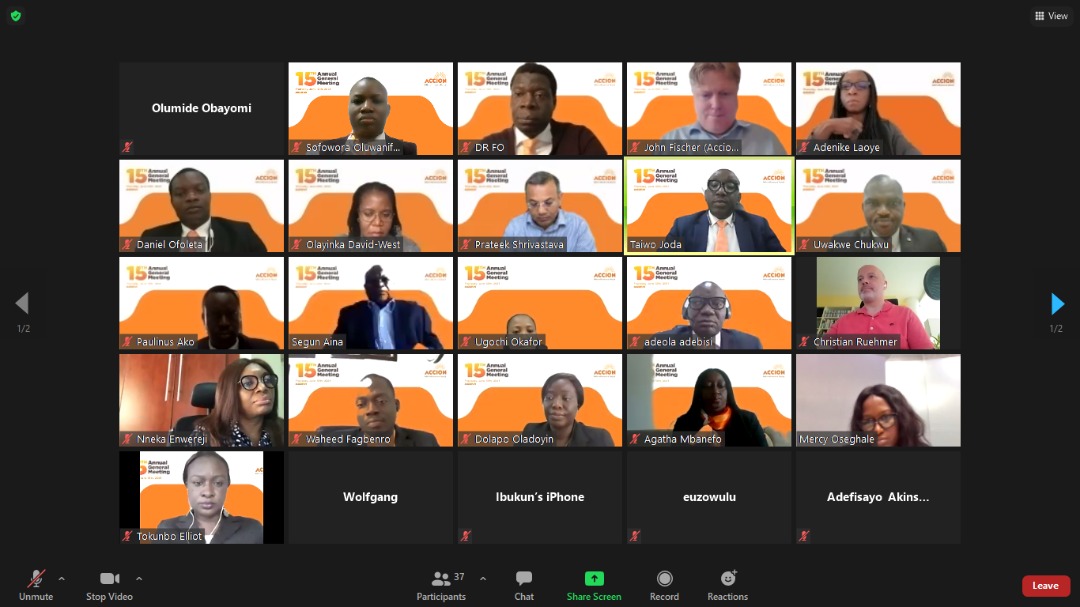

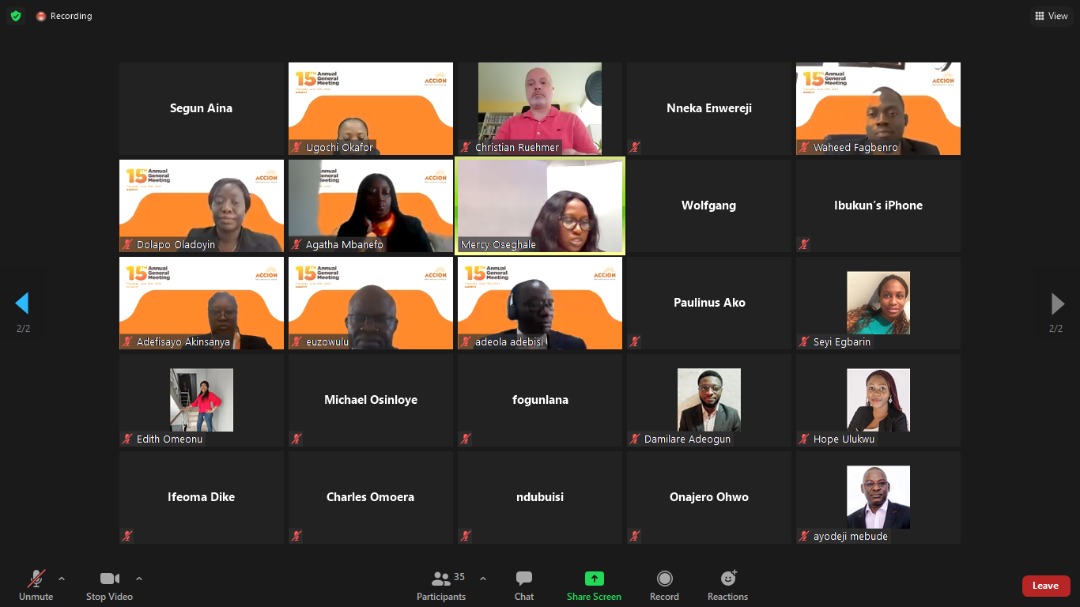

Accion MfB 2020 Annual General Meeting

Accion MfB 2020 Annual General Meeting

Accion Microfinance Bank Limited held her 15th Annual General Meeting (AGM) for the 2020 financial year on Thursday, 10th June, 2021.

In keeping with the new normal, it was the second consecutive year that the AGM was teleconferenced from the boardroom of the company's head office at 322A, Ikorodu Road, Anthony, Lagos State.

The meeting presented an opportunity to review how the bank supported its customers and other stakeholders to navigate the economic challenges brought about by the global pandemic in 2020.

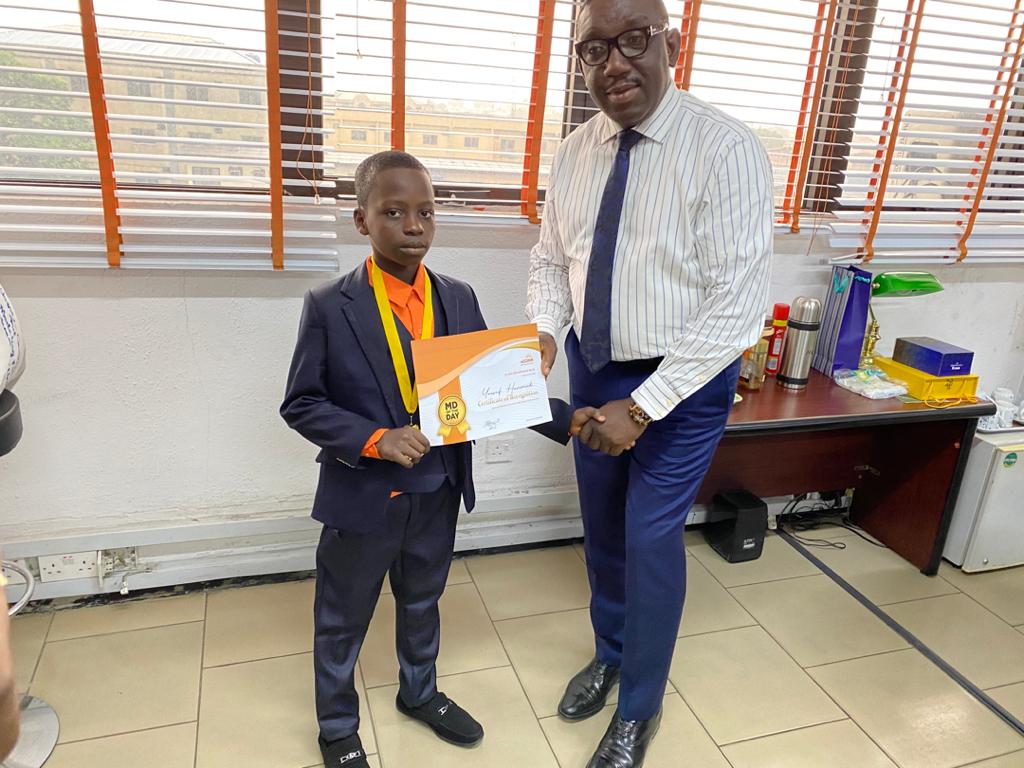

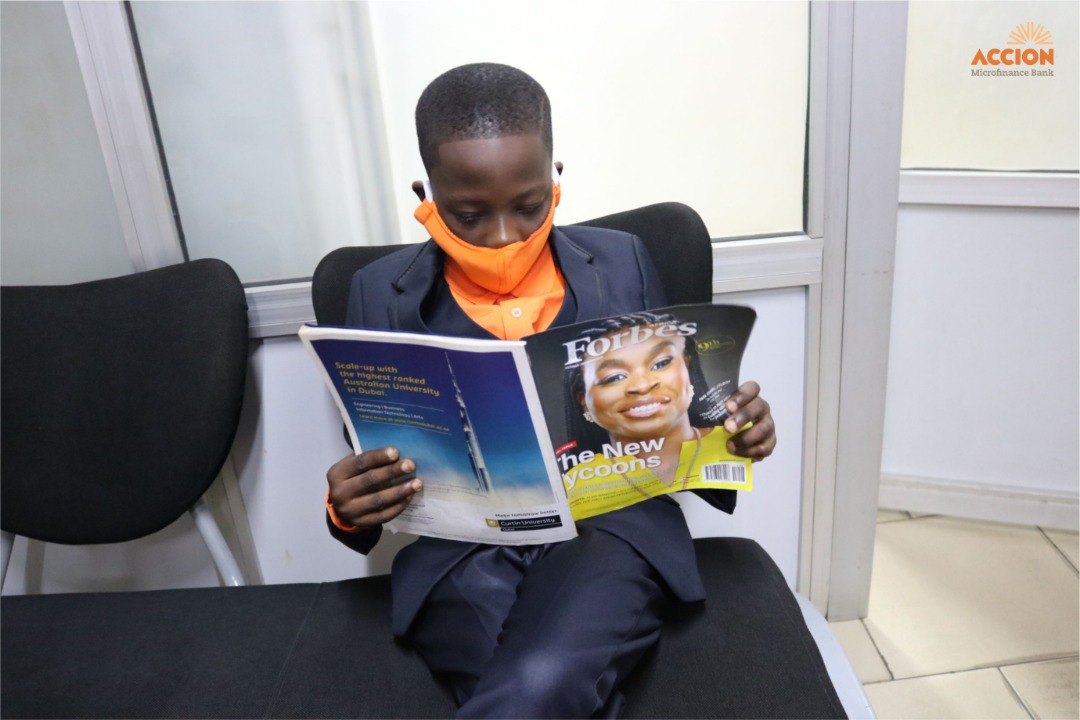

MD of the Day

MD of the Day

As part of our core value to support the next generation, Accion MfB introduced the MD of the Day, where the bank provides

an exclusive opportunity for a youngster to serve as MD/CEO for a day.

The campaign was launched to commemorate Children's Day 2021 and in the first edition, 9-year-old Yusuf Hammed in his capacity

as young CEO, presided over a management meeting and sharing his agenda for the bank. He was also given a guided-tour of the different units in the bank where he learnt about the different operations.

Nigeria Microfinance Platform (6th Annual Symposium)

Nigeria Microfinance Platform (6th Annual Symposium)

Accion MfB in collaboration with Nigerian Microfinance Platform and other stakeholders called for stronger collaboration among microfinance

banks (MFBs) to promote the growth of micro-insurance as a tool for deepening financial inclusion.

Making this call in Lagos at the 6th annual symposium of the Nigerian Microfinance Platform (NMP) organized by the Microfinance Learning and

Development Centre (MLDC) on 'Expanding The Frontiers of Financial Inclusion: The Micro-Insurance Option', the experts noted that MFBs are

instrumental to the expansion of micro-insurance services among the populace

Lagos State Council of Trade and Artisans

Lagos State Council of Trade and Artisans

In partnership with the Lagos State Ministry of Wealth Creation and Employment, and the Lagos Sate Council of Trade and Artisans, we empowered and provided financial support to members of the trade association.

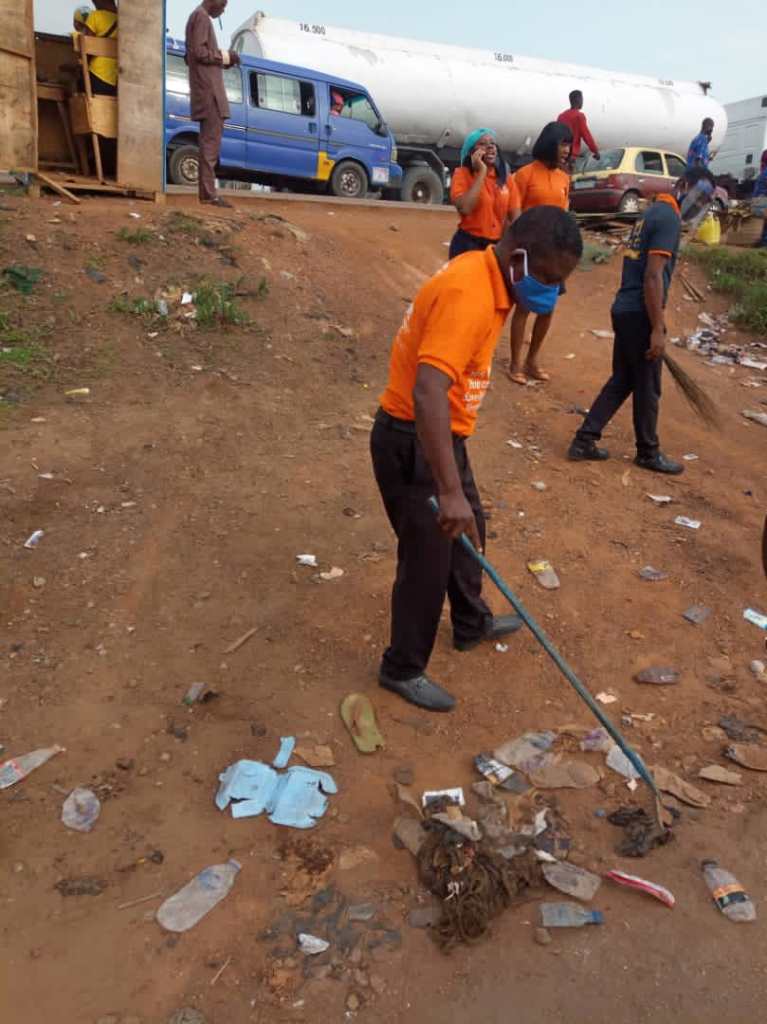

World Environment Day

World Environment Day

The environment is our responsibility to keep. We embarked on a regional market clean up in states where we are operate in Nigeria in celebration of the year 2020: world environmental day. It was an amazing time, connecting with customers while helping to clean up. We do not only care about our customer's finances, we also care about their health and welfare

Shetrades

Shetrades

Accion MfB in collaboration with Nigerian Microfinance Platform and other stakeholders called for stronger collaboration among microfinance

banks (MFBs) to promote the growth of micro-insurance as a tool for deepening financial inclusion.

Making this call in Lagos at the 6th annual symposium of the Nigerian Microfinance Platform (NMP) organized by the Microfinance Learning and

Development Centre (MLDC) on 'Expanding The Frontiers of Financial Inclusion: The Micro-Insurance Option', the experts noted that MFBs are

instrumental to the expansion of micro-insurance services among the populace

Accion Microfinance Bank - NAMBLag

Accion Microfinance Bank - NAMBLag

Accion Microfinance Bank in collaboration with the National Association of Microfinance Banks - Lagos State Chapter (NAMBLag) organized a 1 day Capacity Building seminar for MDs/CEOs and deputies of Microfinance Banks in Lagos state themed: Effective Risk Management and Succession Planning for Microfinance Banks in Lagos State.

Financial Inclusion Seminar

Financial Inclusion Seminar

Accion MfB hosted over 500 delegates to her 3rd annual Financial Inclusion Seminar at the Federal Palace Hotel, Victoria Island, Lagos on December 11th, 2019. Theme: Re-Emerging Microfinance Banks: The Digital Reality.

International Women's Day

International Women's Day

Accion Microfinance Bank hosted some of our widowed customers to a luncheon, in the celebration of the International Women's Day 2019. A one year medical insurance cover worth One Million Naira was given to each of the customers.

FIC 2018

Business Case for Financial Inclusion

Enhancing Financial Innovation & Access (EFInA) has announced the theme and agenda for this year's Financial Inclusion Conference (FIC 2018) which will hold in Lagos on the 6th of November, 2018 at the Eko Hotel and Suites from 8.30am.

Companies To Inspire Africa

Companies To Inspire Africa

What have been the biggest opportunities for your company since 31 March 2017? Since 31 March, 2017, we've seen more funding opportunities from multilateral and development institutions. We obtained 500 million from an international bank in July 2017, which has allowed us to offer more financial services to the financially underserved and excluded individuals. In November 2017 we obtained 1 billion from a Development Finance Institution, which has permitted us to increase the bank’s penetration in lending to micro, small and medium-sized enterprises, and we continue to pursue funding sources to permit us to achieve our objectives.

We are looking to partner with Fintech companies to drive digital lending. We now have a partner that has allowed us to reach more clients online. We've now disbursed over 75m to over 5000 new clients through digital lending. The intention is to acquire 50,000 new clients in 2018 and service them through our own digital platform.

We always seek opportunities to automate our key processes and customer experience. The bank has deployed an automated credit processes through Digital Field Application (DFA) to enhance credit appraisal turn-around time. More than 400 account officers are currently using the field tablets in routing credit requests of customers to the Credit Processing Credit (CPC) who respond in a timely manner. This has greatly improved efficiency and reduced turnaround time in the loan approval process.

What have been the key drivers of the growth of your company? Several factors continue to contribute to the growth of Accion. These include our strong management team, continued focus on automation, growth in our distribution centres, and deploying innovative products and services.

What challenges has your industry/region faced last year and how have you managed to deal with them? Nigeria emerged from an economic recession in 2017 and that had a tremendous impact on Accion. The period of economic doldrums affected businesses negatively thereby slowing disbursement and loan portfolio growth. Many clients could not renew their loans and others allowed their facilities to go bad. We managed this by focusing our disbursements more on the essential sectors of economy. We used the recession as an opportunity to enhance our processes and procedures, for example, we registered two reputable credit bureau for credit checks on our platform as an additional process for loan approval.

Increased regulation also continues to impact our business. The new Central Bank of Nigeria’s guide to bank charges moderated what banks earn from charges. Within the ambit of the new guide, we made some changes to our charges.

What is the significance of the recent fundraising close? The loan facility from Citibank came in local currency, which does not have any form of exchange risk. This funding will enable the Bank to expand its financial services to a larger number of micro entrepreneurs across the country leading to economic empowerment and job creation for more Nigerians. In order words, it helps Accion MfB achieve its passionate drive for financial inclusion in Nigeria’s economic space.

Asaba Branch Launch

Asaba Branch Launch

Official Launch of Asaba Branch held on 6th September 2018. Gracing the occasion was the governor of Delta state who was ably represented by the commissioner of Finance Mr. David Edevwe. Also in attendance was the Chief Anthony Nwosa representing the Asagba of Asaba.

Accion MfB 2018 AGM

Accion MfB 2018 AGM

The 2018 Annual General Meeting held at Radisson Hotel, Ikeja on May 23rd, 2019. At the event, the 2018 annual report was unveiled. We have leveraged on technology initiatives to deliver super-impressive results in 2018, also introduced was the newly innovated QR scan card to access the e-copy of the annual report.

2018 Annual Customer Forum

2018 Annual Customer Forum

Accion Microfinance Bank during her 2018 annual customer forum for Lagos and Ogun state, appreciated some of her persons living with disability for their zeal to use our loan to transform their lives and do business despite thier challenges. This underscores our resolve to create positive impact and provide a brighter future by simplifying access to finance to the deserving, but undeserved communities nationwide.

2018 Accion MfB Financial Inclusion Seminar

2018 Accion MfB Financial Inclusion Seminar

The 2018 Annual General Meeting held at Radisson Hotel, Ikeja on May 23rd, 2019. At the event, the 2018 annual report was unveiled. We have leveraged on technology initiatives to deliver super-impressive results in 2018, also introduced was the newly innovated QR scan card to access the e-copy of the annual report.

Accion MFB Is Among The Best Working Places

Accion MfB Named Among The Best Working Places

Accion MfB named amongst the best 100 places to work in Nigeria, by Jobberman.

It is a testament to the caliber of staff that we have (past & present) in the organization that they are able to aptly articulate and rightly assess the substance of an organization like Accion MfB Limited. This accolade has everything to do with the valued members of our organization, the Management and Board Members who have continued to support policies that help to bring out the best in us all at Accion MfB.

This independent study conducted by Jobberman had respondents from various industries and it is doubly exciting that we are the only Microfinance bank named and ranking higher than some Commercial banks and other larger Organizations in Nigeria. It is one of the most meaningful awards to be named amongst the best 100 companies to work in Nigeria as this recognizes the value the bank places on our staff.

We are committed to making the future bright for all stakeholders including our employees.

You can read more at : https://www.jobberman.com/blog/jobberman-best-100-companies-work-nigeria-2016/

Accion MfB Holds Her 10th AGM: Reinforces Commitment To Extending 'Boundaries'

Accion MfB 10th AGM

Accion MfB limited held her 10th Annual General Meeting (AGM) on the 10th June, 2016 at the Protea Hotel, Ikeja Lagos. The Chairman Mr Patrick Akinwuntan, presented a review of the financial year ended 31st December 2015. He expressed that the economic landscape for 2015 remained resilient with dwindling global crude oil prices coupled with the security challenges. He commented that "The Bank’s performance continued to be positive in line with the vision of being the market leader in ensuring that Nigerians are financially included.

The Chairman added that 'we are committed; never like before to extending the 'boundaries' on all fronts despite of the challenging atmosphere". He said "Accion MfB’s key performance indicators remained encouraging as the total loan portfolio grew by 28.1% to N5.4bn while the total loans disbursed grew by 33.3% to N13.7bn culminating to the total loan disbursed from inception to the end of December 2015 standing at N46.56bn. The active borrowers grew by 27.9% to 43,788 and number of savers grew by 38.2% to 120,000 leading to the shareholders' funds growth of 16.9% to N3bn in 2015.

He mentioned that though, the Bank had a slight drop in profit after tax to N546 million occasioned primarily by increased investments in people and infrastructures as the Bank seeks to expand the operational base into other states of the country in line with the National Expansion strategy of the Bank.

Mr Patrick Akinwuntan added that 'In 2015, we deepened our market in Lagos by opening 7 branches in Lagos and had our first foray outside Lagos with the commencement of Mile 1 in Port Harcourt, Rivers State'. In 2016, we continued our strategy of extending the boundaries of our operations to other states as well as increasing our presence in Lagos State. In his word, the chairman enthused that 'I am pleased to inform you that we now have operational branches in Ogun State in addition to Lagos and Rivers State and the Bank is prime to commence banking operations in Oyo and Anambra States few weeks from now.

In her address, the MD/CEO of the Bank, Ms Bunmi Lawson expressed that the Bank has invested in technology to offer customers a new paradigm in banking as it regards ease of access and enhanced customer experience. She added that 'we have continued to leverage on technology as a major driver of the Bank’s expansion strategy to get things done easily, quickly and rightly'. The Bank has deployed the Electronic document management system (EDMS) to enhance better data warehousing and management, a pilot run of DFA (Digital Field Application) initiative to create efficiency in our data capturing in the loan process and central credit processing centre with a centralized processing of loans. She said that 'this is a significant step in actualizing our mission to economically empower micro entrepreneurs in Nigeria, ensure they have easy access to financial services and benefit in the brighter future which is the hallmark of Accion MfB.

The Chairman concluded by expressing his appreciation to the entire staff, management and his colleagues on the Board for their commitment, and selfless service, which has enabled the Bank to deliver these results. He also thanked the esteemed customers, for their unalloyed loyalty'. He charged that 'Together we will continue to create a brighter and better future.

Banking In The Easiest Way

Banking In The Easiest Way

Accion MfB, Nigeria has launched a new USSD mobile banking solution to make banking easier, simpler and interesting for all its customers at the bottom of the pyramid who may not afford smartphones.

This is an innovative but yet simple solution launched in partnership with Interswitch (a national Switching platform) called "Brighta 143" uses *322*143# short code. This code allows anyone with a mobile phone to do transactions such as buy airtime, transfer money, pay bills, check balance anytime and anywhere. It also conveniently performs third party transfers to both Accion MfB and other bank account holders in Nigeria.

The Unstructured Supplementary Service Data (USSD) Brighta 143 banking solution enables Accion MfB customers to perform financial transactions on all mobile phones, without having to go on the net or download any mobile apps. The adoption of this technology allows customers to do a lot of banking transactions even on the most basic of mobile phones. The service allows every banking customer to access banking services with a single number irrespective of the telecom service provider, mobile handset make or the region.

To initiate fund transfers to an Accion MfB account, simply dial *322*143*1*Amount*NUBAN Account No# e.g. *322*143#1*2000*1234567890# from the mobile number registered with the Bank. For transfers to beneficiaries in other Bank’s (Deposit Money Bank & MFBs), customers should simply dial *322*143*2*Amount*NUBAN Account No# e.g. **322*143#2*1000*1234567890#. Some of the other transactions that can be performed are: account balance enquiries (*322*143*0#); airtime purchase (*322*143*Airtime Amount*Mobile Number#). *322*143# transactions can only be performed from the phone number registered against a customer’s account with Accion MfB and require a 4-digit PIN for transaction authentication for third party transactions.

The USSD banking solution, Brighta 143 will complement the physical channels such as ATMs and POS devices, it is already well accepted among its teeming and ever growing customers. It positions the Accion MfB for future growth and expansion as it continues deepen its markets outside Lagos and the use of mobile phones becomes the new and preferred banking channel. The *322*143* Transfer service is only available to Accion MfB customers via their mobile phone numbers registered with the Bank and has minimum transfer limit of N1,000 and a daily transfer limit of N20,000.Customers can easily carry out banking activities anytime, anywhere, from the comfort of their mobile phones.

The bank is recognized as one of the most innovative financial and high technology use institutions in Nigeria. This will complement the efforts of the Central Bank of Nigeria (CBN) to build a cashless economy and enhance financial inclusion.

Accion MfB is poised to leverage on technology to make banking transactions especially payments and transfers, faster, safer and more convenient and effective for all our customers as the service fit into the status and lifestyle of the customers because it works irrespective of the phone type". For further enquires, complaints and suggestions, customers can contact 01-2951010 for prompt resolution. Alternatively, they can also send an email to info@accionmfb.com , follow the Bank on Facebook at www.facebook.com/accionmfb, Twitter at twitter@accionmfb, or simply walk into any of our branches nationwide.

Marketing Communications Department

Accion MfB In - Branch POS Reaches N1billion Value

Accion Branch POS Reaches N1billion Value

Accion MfB, the multi award winning leading microfinance in Nigeria has added yet another feather to its cap hitting the mark of N1Billon values of transactions processed through the In-Branch Point of Sales (POS) devices.

The Managing Director, Ms Bunmi Lawson announced this in the recent Half year review meeting. In her word she said "this is the first time we have managed to break this ceiling in a single month and this has assuredly set us on the increase mode". She added that the Bank has been able to achieve this N1 Billion with an approximate of over 14, 500 Branch Transactions in the same period.

Accion MfB always seeks to leverage on technology to enhance the ease of financial access through a simple, convenient and quick platforms and channels. To this end, the In-branch POS devices were deployed in our branches in August 2015 to allow customers to conduct faster Cash Deposits and Withdrawals at the Teller points. This is a paperless operation which makes it more cost effective as it also provides faster turnaround (shorter queues). This is a significant milestone in our drive to ensure process efficiency and superior service delivery; she reinstated.

The MD/CEO also added that in the course of the year, "we continued to leverage on technology as a major driver of the Bank’s expansion strategy to enable us achieve our objective of getting things done easily, quickly and rightly. She expressed that the Electronic document management system (EDMS) is intended to enhance better data management which is meant to support the National expansion strategy. Other projects include the pilot run of the DFA (Digital Field Application) initiative which is intended to create efficiency in our data capturing in the loan process.

She said that Accion MfB is committed to actualizing our mission to economically empower micro entrepreneurs in Nigeria, by ensuring that they have easy access to financial services and benefit in the brighter future as the Bank is set to making multiple entry into Anambra and Oyo States states of the country simultaneously in line with the national expansion strategy.

She congratulated all Branch Managers, Operations Staff and all the Accion MfB Team for this success as they encourage all our customers to use the In-branch POS and our debit card.

Accion MfB Opens two branches in Ogun State

Accion MfB Open New Branches

Accion MfB limited, the leading and multiple awards winning microfinance bank debuts in Ogun State by the opening two branches to economically empower the low income earners and the people at the bottom of the pyramid. The bank opened the branches at Sango Otta, a popular industrial area of the state and Akute, an upcoming commercial area. The entry to Ogun State was heralded by the formal opening of the Sango Ota branch.

Accion MfB commenced operation in 2007, It was granted license by the Central Bank of Nigeria as a National Microfinance bank in 2014 with very strong shareholders including three of the leading Commercial banks in Nigeria: Zenith Bank, Ecobank and Citibank, as well as other global financial institutions: IFC, a member of the World Bank, and ACCION Investments in Nigeria ably complemented by the expertise of our technical partners, ACCION International.

The Managing Director of Accion MfB, Bunmi Lawson at the event of the bank in Sango Ota said 'The bank is set to offers its variety of financial services and products ranging from savings, current, fixed deposit accounts, micro loans, Asset Loan, SME- small and medium enterprises loans, insurance and e- channels. She expressed that this is an initiative meant not just to lend hand to government efforts in alleviating poverty among the low income earners and people in the bottom of the pyramid but will also offer other socio- economic benefits to the host community. In her words, she enthused that the bank’s long awaited commencement in Ogun state will further re-enforce the bank’s capacity to serve the teeming and growing customers in line with the mission 'to economically empower micro-entrepreneurs and low income earners by providing financial services in a sustainable, ethical and profitable manner as it also envisioned to be the market leader in the provision of microfinance and related financial services, at world class standards.

The Honourable Commissioner of Finance for Ogun state who was the special guest of honour in the epic event commended Accion MfB for the enviable feat since inception in empowering the microenterpreneurs and particular happy that coming to Ogun state. He said ' that this is seen as a positive step in a positive direction in a time when the government of Ogun state is developing a strong private public partnership in key sectors of the economy having identified agriculture and micro, small and medium enterprenuership (MSME) as the key drivers of growth, wealth creation and poverty alleviation. The Managing Directors also proudly expressed that Accion MfB currently operates 31 branches in Lagos and 2 in Port Harcourt. Having disbursed over NGN 50Billion easy �?? to- access loans to about 227 thousand people since inception, the bank is prime to grow its branches upto 10 (ten) in Ogun state before the end of 2017 and aggressively make inroad into additional states this year in line with its national expansion strategy.

Some of the eminent personalities that grace the occasion include Chief Mrs. Alice Obasanjo, the wife of former President of Nigeria, Chief Olusegun Obasanjo. Ogun State Commissioner of Finance, Government dignitaries, Royal fathers and mothers, market leaders etc.

Accion MfB empowers the diable people

Acion MfB Empowers Diable People

ACCION MICROFINANCE PROMOTES AND ECONOMICALLY EMPOWERS THE DIABLED PEOPLE. 'For every disability you have you are blessed with more than enough abilities to meet your challenges' .....Nick Kujicit According to the world record, over 1 billion people, about 15% of the world’s population have one disability or the other in which 80% of these live in Africa. Research work indicates that the disabled people face significant financial challenges; they are more likely to be unemployed, be low paid and twice as likely to be living in persistent poverty and that they are likely not to have savings or bank accounts than non-disabled people.

Accion MfB sharing the sentiment of the quote above moved to economically empower the disabled people introduce a product for people living with disabilities. The product is meant as to enable the economically active ones that are financially excluded to make self-sustaining economic contributions and better their fortunes in life. Accion MFB has put in place frameworks to ensure that persons with disabilities enjoy equal and fair access to quality financial products and services. Accion MfB, a leading microfinance bank in Nigeria was licensed by Central Bank of Nigeria and it started operation in 2007 with a mission of targeting the financially excluded with financial services in a sustainable, ethical and profitable manner. The bank became a national microfinance bank and licensed as such in December 2014 having met the minimum capital requirement as prescribed by the CBN.

Accion MfB launched the People Living with Disabilities (PWLD) product with the support of the Central Bank of Nigeria in 2015. The product is targeted at persons with disabilities who have a desire and ability to be economically active and can tap into the power of financial services to unleash their potential and build self-sufficiency. The product is meant to provide loans to a marginalized group that has largely been left out of the financial system �?? people with disabilities (PWD). To mark the occasion, some of the first clients of these loans including a member of the albino community and visually impaired clients attended an opening ceremony, which also included officials from the Central Bank of Nigeria (CBN). The PLWD launch was the result of close collaboration across organizations and continents. CFI’s Joshua Goldstein and Bunmi Lawson, Managing Director/CEO of Accion MfB, met with officials from the Central Bank of Nigeria to garner their support. In addition, CFI’s PWD team in India, including CFI partner v-shesh, advised Accion MfB. The product is specially designed to provide a product that was specially designed to provide financial services to the economically active disabled. This product was subsidized by CBN with 220m MSME Development Fund with a very low interest rate without administrative fee meaning that the cost of funds is almost next to nothing as compared to applicable interest charge on regular products. The product pilot run was carried out in 4 branches over a period of 6 months. Both individual and focus group were undertaken. The product development was quite unique and challenging from the research level which involve the rigorous fact finding missions and include the training of the staff of the bank. The uniqueness of the product calls for the distinct assessment criteria which are • Physical observation are documented by Loan Officers during evaluation (visually, hearing, speech and mobility impaired). • Determine available means of support to meet the required documentations to the loan either from association, relatives/friends and business environment of clients • Proof of membership of relevant association • The clients must be asked if he/she can read, write or do both and all information gathered should be documented by LO during evaluation. • Exceptional approval on disbursement and collections.

The general requirement for loan was simplified as - Must be a Nigerian citizen and staying in Lagos - Aged �?? between 18 and 65 years. - Valid passport , Identity card or recommended letter - Must have been in business for a minimum of 6 �?? 12 months - Must have an identifiable and verifiable business address - The business must be adjudged viable to pay back the loan & empower borrower. - Must have an acceptable social guarantor. - A compulsory deposit of 20% is required for all categories of first loans.

The product was specifically designed to inculcate both our Individual and Group lending methodologies. In other words, credible clients can collect loans either individually or as a group. The interest rate of 9% on loan amount of 50,000 �?? 399,999 with a monthly repayment for individual while the group loan amount is N12,500 to N50,000 with a weekly repayment terms.

There exists a huge untapped market in this segment of the populace, therefore there is need to understand the different disabilities that abound in this sector.

Accion MfB looks forward to this important milestone as it heralds the delivering the 'brighter future' to its teeming and growing clients by economically empowering them to fulfill their business dreams.

Key Challenges Some of the key challenges are • Sales Approach �?? the approach is quite different from the conventional customers as the client’s needs some support and waivers on the KYC and other documentation and disbursement requirement. The delinquency issue is a major albatross of the products. Most of the people reckon it to be one of the government largesse and for people that have hearing impairment, communication is at challenge however the product has shown excellent performance by the clients with zero PAR Next Line of Action • There is a drive to reach more credible PLWD’s as possible as we intend to work closely with different disability organization Association such as Nigerian Association of the Blind (NAB), Joint Association Of People Living With Disabilities (JONAPWD and The Albino Foundation).

Accion MfB Takes Financial Inclusion To Anambra & Oyo States

Accion Financial Inclusion

Accion MfB limited, the multiple awards winning microfinance bank is highly delighted to announce its entry into Anambra and Oyo states in this month of August 2016. The bank is set to commence operations in the two cities of Onitsha and Ibadan owing to the commercial viability of the cities.

Accion MfB, a leading microfinance bank in Nigeria was licensed by Central Bank of Nigeria and it started operation in 2007 with a mission of targeting the financially excluded with financial services in a sustainable, ethical and profitable manner. The bank became a national microfinance bank and licensed as such in December 2014 having met the minimum capital requirement as prescribed by the CBN.

With its solid shareholder investments from Accion International and three major banks �?? Ecobank, Zenith Bank and Citi Bank �?? as well as International Finance Corporation (IFC), a subsidiary of the World Bank. The bank since inception, has disbursed about NGN 50Billion easy �?? to- access loans to about 250, 000 people.

The bank currently operates 34 branches and now exists in Ogun and Rivers States where its offering variety of financial services and products ranging from savings, current, fixed deposit accounts, micro loans, Asset Loan, SME- small and medium enterprises loans, insurance and e- channels which will definitely lend hand to government efforts in alleviating poverty among the low income earners and people in the bottom of the pyramid and offer other socio- economic benefits to the host community. Accion MfB looks forward to this important milestone as it heralds the delivering the 'brighter future' to its teeming and growing clients by economically empowering them to fulfill their business dreams in these respective states.

Accion MfB opens new branch in Port Harcourt

New Accion MfB Branches In Port Harcourt

Port Harcourt, Nigeria. 20 October 2015. Accion MfB, one of Nigeria’s leading microfinance banks, has formally opened its new branch in Port Harcourt, Rivers State. The Port Harcourt Branch, the first outside Lagos, is in realisation of the bank’s national expansion programme. Accion MfB is expanding across Nigeria to further provide professional financial services to customers mainly in the lower strata of society who are unbanked or do not have access to regular banking services.

Declaring the Port Harcourt Branch open, Accion MfB Managing Director/CEO Mrs Bunmi Lawson said, "We have consistently transformed our customer’s businesses by giving them easy access to loans and other financial services. This is the value we bring to Rivers State. We will continue to serve our customers to give them a brighter future".

At the branch opening event, several guests and small business owners in the immediate vicinity took the opportunity to open accounts with the bank. Officers of the bank were on hand to introduce the bank’s products and services. Commending the bank on the opening of the Port Harcourt Branch the Rivers State deputy Governor Dr. Mrs. Ibalibo Harry Banigo who was represented by the Senior Special Assistant Barrister Gilbert Nirai, said the Rivers State government would create an enabling environment and support microfinance activity in the State.

The event was also attended by residents in the area, community leaders, market leaders, traders and trade associations from Mile 1 and neighboring markets.

Established in 2007, Accion MfB has solid shareholder investments from Accion Investments, three major banks �?? Ecobank, Zenith Bank and Citi Bank �?? as well as the International Finance Corporation, who is a member of the World Bank; all of which contributes to its strong financial base and allows it to service an ever-increasing number of customers. With a current customer-base of over 168,000, a fully paid-up share capital of N1.205 billion by December 2014 and total assets of over N3.06 billion in the same year, Accion MfB has disbursed over N38.5bn in loans to more than 36,000 customers since inception.

The opening of a new branch in Port Harcourt further emphasizes Accion MfB’s mission to economically empower micro-entrepreneurs and low income earners by providing financial services in a sustainable, ethical and profitable manner thus improving the socio-economic well-being of Nigerians. It also demonstrates the bank’s commitment to financial inclusion in the country. Accion MfB has 28 branches in Lagos.

Accion MfB Disburses Loans to People Living With Disability

Disbursement To Disable People

Lagos, Nigeria. 30th September 2015. Accion MfB, one of Nigeria’s leading microfinance banks, has begun the disbursement of the loans to people living with impaired disability with a new product called PLWD. The disbursement of loans to people living with impaired disability is made possible with the Micro, Small and Medium Enterprises Development Fund (MSMEDF) from the Central Bank of Nigeria (CBN).

According to the bank, the product appropriately named PLWD (People Living With Disability) which aims to give loans to persons with impaired disability, aligns closely with the bank’s strategy for creating brighter futures for her customers. This is achieved by giving them the opportunity to improve their socio-economic wellbeing with loans to enhance their businesses. This, the bank believes promotes growth and development which is a viable factor towards achieving financial inclusion as well as the millennium development goals.

Speaking at a ceremony which took place at the Ikorodu Branch of Accion MfB to mark the commencement of the disbursement of the PLWD loan, Mrs Bunmi Lawson MD/CEO Accion MfB said, "Many people living with impaired disability are financially excluded. We are pleased to be able to give them the opportunity to improve their means of livelihood to give them a brighter future".

The first PLWD Loans were received by Mrs. Josephine Omolola of the Albino Community, Mrs. Margaret Nmezi who is visually impaired and four other persons who are also visually impaired. The event was attended by CBN officials including Mr Jonathan Tobin, Assistant Director MSMED Fund who expressed his satisfaction that Accion MfB was utilizing the MSMED Funds for a great cause and commended the bank for its commitment to financial inclusion. Also in attendance was Mrs. Temitope Akin-Fadeyi Head, Financial Inclusion Secretariat of the CBN.

Speaking on behalf of the loan recipients, Mrs. Omolola thanked Accion MfB for considering people living with impaired disabilities and promised to ensure the loans were repaid when due.

Accion MfB aims to utilize the MSMED Funds for sustainable development towards financial inclusion. The MSMED Fund forms part of the CBN framework for developmental functions which aims to promote financial inclusion in Nigeria through the provision of funding to micro-entrepreneurs.